colorado springs vehicle sales tax rate

5 rows The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales. To account for depreciation the SOT tax rate decreases as the vehicle ages until it hits a flat rate in the tenth vehicle year as shown in Table 2 on page 2.

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

In Colorado localities are allowed to collect local sales taxes of up to 420in addition to the Colorado state sales tax.

. The vehicle is principally operated and maintained in Colorado Springs. The sales tax is remitted on the DR 0100 Retail Sales Tax Return. Colorado collects a 29 state sales tax rate on the purchase of all vehicles.

Considered retail sales and are subject to Colorado sales tax. Effective January 1 2022 increase of 5 for Measure 2F for the Monument Police Department. 010 Trails Open Space and Parks TOPS.

In addition to taxes car purchases in Colorado may be subject to other fees like registration title and plate fees. However a lease for a term of 36 months or less is tax-exempt if the lessor has paid Colorado sales or use tax on the acquisition of the leased property. Putting this all together the total sales tax paid by Colorado Springs residents comes to 825 percent.

Box 15819 Colorado Springs CO 80935-5819. Background - Understand the importance of properly completing the DR 0024 form. The sales tax is remitted on the DR 0100 Retail Sales Tax Return.

Sales tax change from 3 to 35. On a 30000 vehicle thats 2475. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

2022 Colorado state sales tax. For more information regarding sales tax or to apply for a sales tax license please visit the Colorado Department of Revenues website. When purchasing a new car the individual p roperly paid city sales tax to the dealer and registered h.

The Colorado sales tax Service Fee rate also known as Vendors Fee is 00400 40 with a Cap of 100000. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. This is the estimated amount that you will have.

Net taxable sales greater than 100000000 Service Fee reduced to zero. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax. 6 rows The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state.

Use 20 Sales 375. 4 rows The current total local sales tax rate in Colorado Springs CO is 8200. To cite an example the total sales tax charged for residents of Denver amounts to 772 percent.

The County sales tax rate is. Use 38 Sales 39. A lessor may submit a completed Lessor Registration for Sales Tax Collection DR 0440 to the Department to.

The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. 312 City of Colorado Springs self-collected 200 General Fund. The Colorado sales tax rate is currently.

Of the forty-five states and the District of Columbia with a statewide sales tax Colorados 29 percent rate is the lowest. Sales tax is applied to the purchase of a vehicle by a business in the same manner that it is applied to the purchase of a vehicle by an individual27442 leased vehicles a motor vehicle leased for 30 or more days by a colorado springs The minimum combined 2021 sales tax rate for boulder colorado is. Although the taxes charged vary according to location the taxes include Colorado state tax RTD tax and city tax.

All PPRTA Pikes Peak Rural Transportation Authority. Fountain Live in Buy in. What is the sales tax rate in Colorado Springs Colorado.

To find out your auto sales tax take the sales price of your vehicle and calculate 772 percent of this price. Manitou Springs Live in Buy in. CO 80203 303-866-3521 lcsgastatecous legcoloradogovlcs Table 2 Tax Rates by Model Year Source.

Monument Live in Buy in. Vehicle Fee Vehicle Fee Motorcycle 490 Motorcycle 1300. A Colorado Springs resident owns a home in the C ity and a ranch in the mountains.

The maximum tax that can be owed is 525 dollars. Sales Tax Information - City of Westminster The Colorado Springs sales tax rate is. You can find these.

Commerce City CO Sales Tax Rate. The Colorado Springs sales tax rate is. Colorado Springs CO Sales Tax Rate.

This is the total of state county and city sales tax rates. Effective January 1 2016 through December 31 2020 the City of Colorado Springs sales and use tax rate is 312 for all transactions occurring during this date range. Did South Dakota v.

Vehicle Fee Vehicle Fee Motorcycle 490 Motorcycle 1300. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Irs Tax Forms Infographic Tax Relief Center Irs Taxes Irs Tax Forms Tax Forms.

DR 0800 - Use the DR 0800 to look up local jurisdiction codes. The combined amount was 825 broken out as followed. Sales Tax for Vehicle Sales DR 0024 Form After completing this course you will be able to do the following.

Welcome to the City of Colorado Springs Sales Tax Filing and Payment Portal Powered by. DR 0100 - Learn how to fill out the Retail Sales Tax Return DR 0100.

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

How Colorado Taxes Work Auto Dealers Dealr Tax

Health Insurance Tax Making Health Care More Expensive Health Insurance Infographic Infographic Health Health Literacy

Sales Use Tax Department Of Revenue Taxation

Irs Tax Forms Infographic Tax Relief Center Irs Taxes Irs Tax Forms Tax Forms

How Colorado Taxes Work Auto Dealers Dealr Tax

Wyoming Sales Tax Small Business Guide Truic

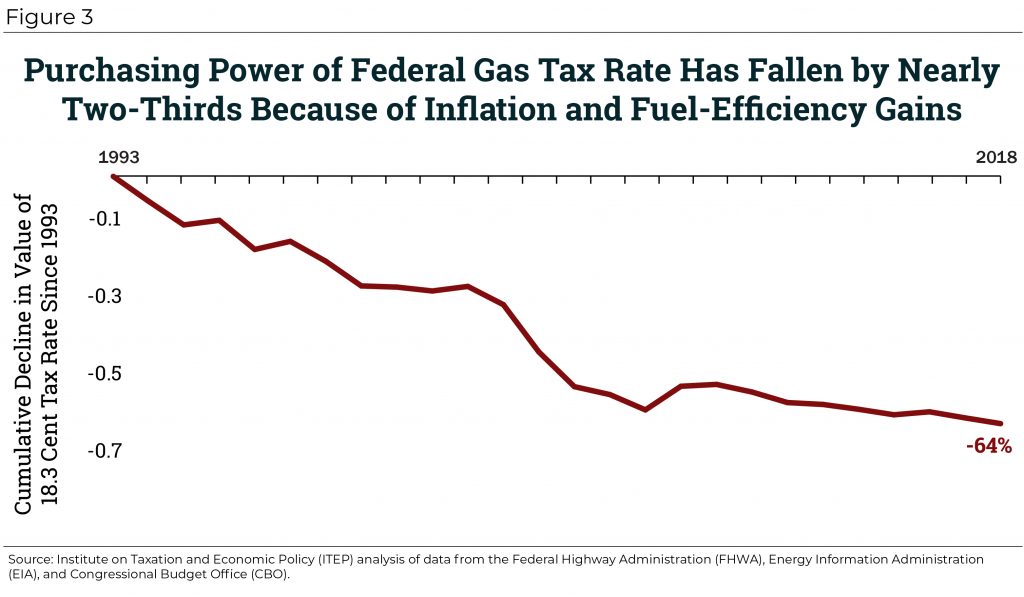

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Tax Deductions Printable Checklist Receipt Organization

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

How To Calculate Sales Tax Definition Formula Example

The El Paso County Colorado Local Sales Tax Rate Is A Minimum Of 4 13

Bankerbhai Expense Inflation Calculator Investment Finance Homeloan Loan Personalloan Fridayfeeling Exitpol Business Tax Financial Planning Tax Prep

Pin By Alicia Hunt On Budgeting Tax Prep Checklist Tax Prep Small Business Tax